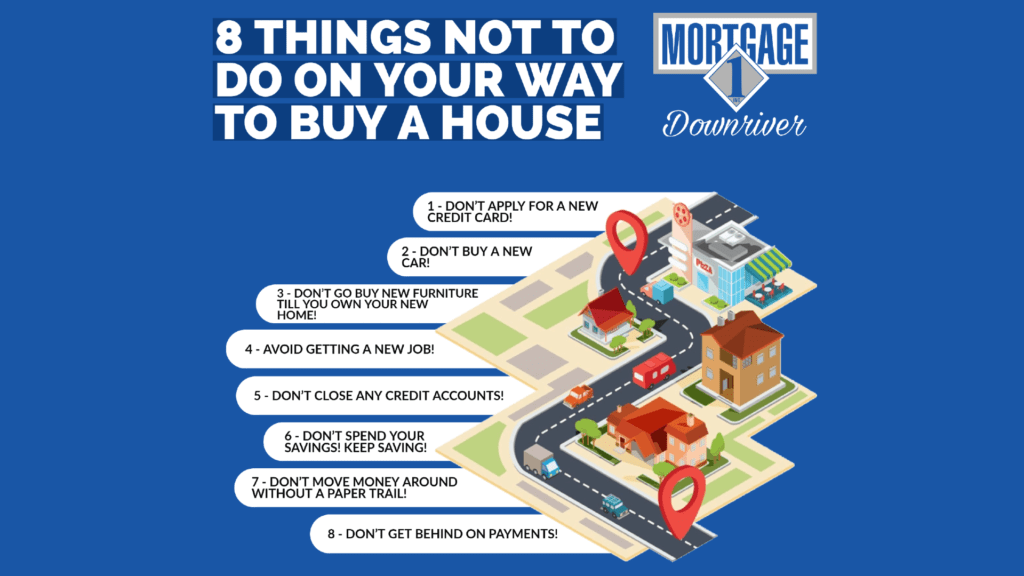

When wanting to purchase a home, it’s important to know how the mortgage process works and what to do. Preparing yourself before applying for a mortgage will put you in a better position to buy and maximize your approval amount. So, while it’s important to know the do’s, it’s as equally important to know the dont’s.

- Don’t apply for a new credit card.

- Don’t buy a new car.

- Don’t go buy new furniture until you own your new home.

- Avoid getting a new job.

- Don’t close any credit accounts.

- Don’t spend your savings. Keep saving.

- Don’t move your money around without a paper trail.

- Don’t get behind on payments.